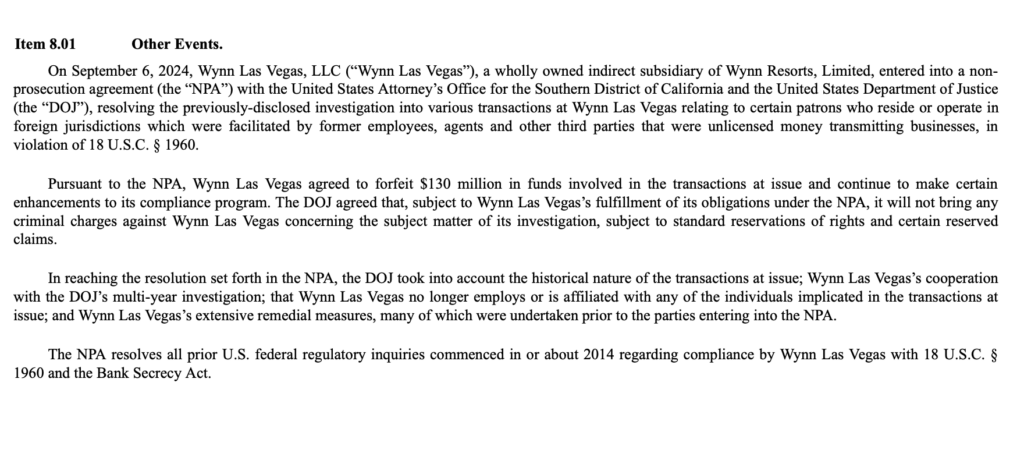

Wynn Resorts has accepted the charges of doing illegal money transfers they made to their casino in Las Vegas. Federal authorities pushed Wynn Resorts into making a settlement to pay $130 million.

Wynn Made a Settlement

The settlement will help Wynn dodge criminal charges and will require them to make business more transparent under certain regulations.

Federal authorities have noted that big transactions were coming from international companies who were trying to avoid US tax law. However, casinos are responsible for following all the US laws and not trying to avoid them to gain profits or avoid costs.

Wynn was using third-party agents to transfer illegal money and bring more international gamblers to their casinos. The agents were transferring gamblers’ money through various streams like bank accounts, operators in Latin America, companies, and others into Wynn’s bank account. Employees manually edited money into each gambler’s account after it came to the casino.

Is Wynn the only casino doing this kind of business, or should we expect more charges and settlements like this?

MGM Grand Anti-Money Laundering Charges

There was similar case few months earlier where former president of MGM Grand Casino, Scott Sibella got one year of probation after making the deal with federal autorities for violating anti-money laundering laws.

The former president allowed a bookie to gamble large amounts of money at MGM casino without reporting it to the authorities. Sibella was released from his presidential position after he failed to disclose certain information required under the company’s policies.

Federal and state authorities continue to investigate casinos chasing profit and ignoring US anti-money laundering laws.